If you’re worried about money lately, you aren’t alone. Many Americans are cutting spending, with 62% worried that a major recession is ahead. While it’s good to be smart with your money and avoid overspending, you also don’t want your finances to be cause for concern. The way you think about your personal finances—your money mindset—can play a big role in your relationship with money as a whole. Read on to learn how to create a positive money mindset that can set you up for greater success.

Identify your harmful views on money

The first step in building a more positive money mindset is to tackle negative views you have that may be damaging your relationship with money. CNBC outlines some harmful money viewpoints that you may need to tackle, such as money avoidance—the idea that rich people are greedy and money is corrupting and that it’s virtuous to live with less money. These harmful views are often inherited from parents or even grandparents and can become unconscious “scripts” that you stick to. To break them, it’s important to identify them and then counter them with more positive viewpoints, as detailed in the next section.

Build positive money mindset habits

Once you have an idea of what harmful money scripts you may be adhering to, it’s time to tackle them head-on. For example, if you discover that you have a money-avoidant mindset, reframe your thinking. Instead of seeing money as evil, consider the good that it can do, both in your personal life and in the world at large. Other techniques for building positive views on money include forgiving yourself for past financial errors, focusing on yourself instead of comparing yourself to others, and crafting a budget that brings you happiness.

Find ways to create more abundance

Finding ways to earn more money can create abundance in your life and promote greater stability. For example, if you aren’t happy with your current income, try to find a job that pays more. Money Under 30 offers tips for landing a more lucrative job, such as using job boards, finding a career coach, and lining up stellar references. It’s also important to update your curriculum vitae, C.V., to showcase your skills. Try this template for a CV You can personalize the template with your own photos, colors, images, and text.

Consider starting your own business

If you want even greater control over your professional life and financial future, consider starting your own company instead of looking for a new job. Start by drafting a business plan. Then, take the administrative steps needed, like registering your business as a formal entity. A limited liability company, LLC, is a popular choice of entity among small business owners, as it streamlines tax filing and protects your personal liability. When you form your LLC, you’ll need to designate a registered agent who can accept legal and government documents on your company’s behalf. A registered agent service can do the job for you.

Get more stringent about cutting costs and saving money

In addition to earning more money, you can also gain a healthier money mindset by saving more money. Be The Budget offers tips for getting started, like dining out less frequently, finding a cheaper car insurance plan, and hanging on to your old phone instead of constantly upgrading. As you spend less, you’ll also be able to save more, creating a rainy-day fund that can give you peace of mind. Other ways to save more money include setting up a designated savings account and tackling your debts.

Money worries can be nerve-wracking, literally keeping you up at night. By adapting your money mindset, you can reduce stress and set yourself up for greater success. The above guide provides some tips to help, like finding a new job or starting your own business. Seizing control of your finances will bring you peace and set you up for greater success.

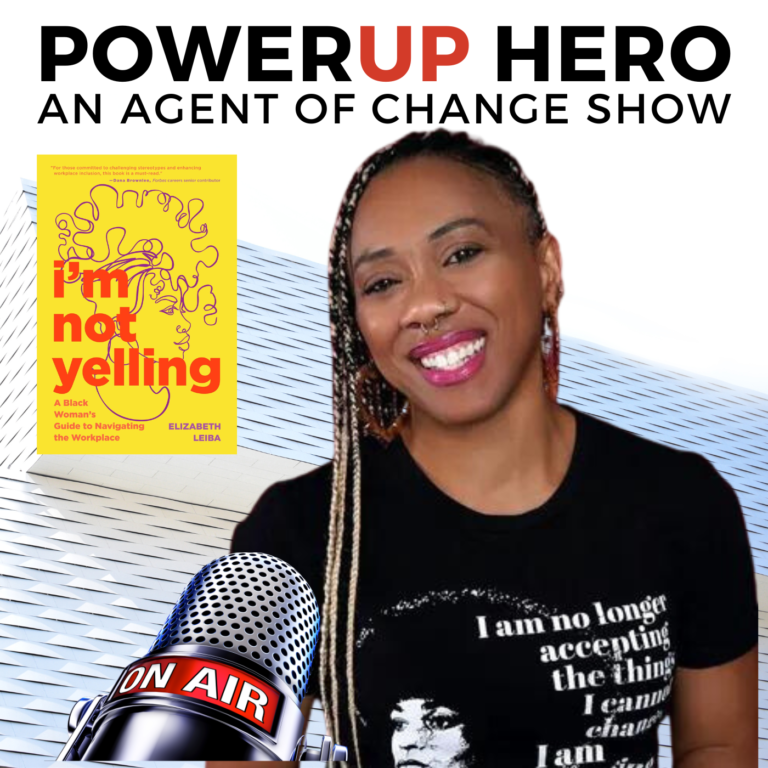

For more empowering content like this, visit the Power Up Hero blog.

Written by Erin Reynolds.